Our Team

Experienced, Dedicated, Independent.

Ambrose Tan

Chief Executive Officer

Kevin Fan, CFA

Chief Investment Officer

Essie Cen

Executive Director

Ariel Ong

Business Operations Manager

Rachel Koh

Business Development Executive

Yee Er Chang

Marketing Director

Our 6 Core Principles

Built Around Your Needs

Our advice begins with your goals—not generic market predictions. We design portfolios with your real-life objectives at the center.

True Diversification

We go beyond the typical stock-and-bond mix. You gain access to alternative strategies not commonly available in traditional portfolios.

Think in Decades, Not Quarters

We focus on long-term results, not short-term noise. Our disciplined approach is designed to stay the course, helping you avoid reactive decisions.

Complete Independence

Our open-architecture model means we choose only what's best for you, without hidden fees or conflicted incentives.

Specialist-Led Portfolios

We identify and partner with elite fund managers who consistently demonstrate expertise in their specific asset classes.

Resilient by Design

Our goal is to minimize inter-correlation to enhance durability. Thoughtful allocation protects during downturns while keeping you positioned for opportunity.

The Keys to Our Success

Manager Selection:

How We Execute on Expertise

As part of our specialist-led approach, we identify and partner with elite fund managers who are entrusted with key responsibilities in security selection and market timing. These relationships provide institutional-level access, without additional layers of cost.

Due Diligence:

The Engine That Drives Us

Our process goes beyond performance stats—it evaluates the integrity, transparency and alignment of every manager we partner with. From initial screening to ongoing oversight, we ensure your capital is managed with care and accountability.

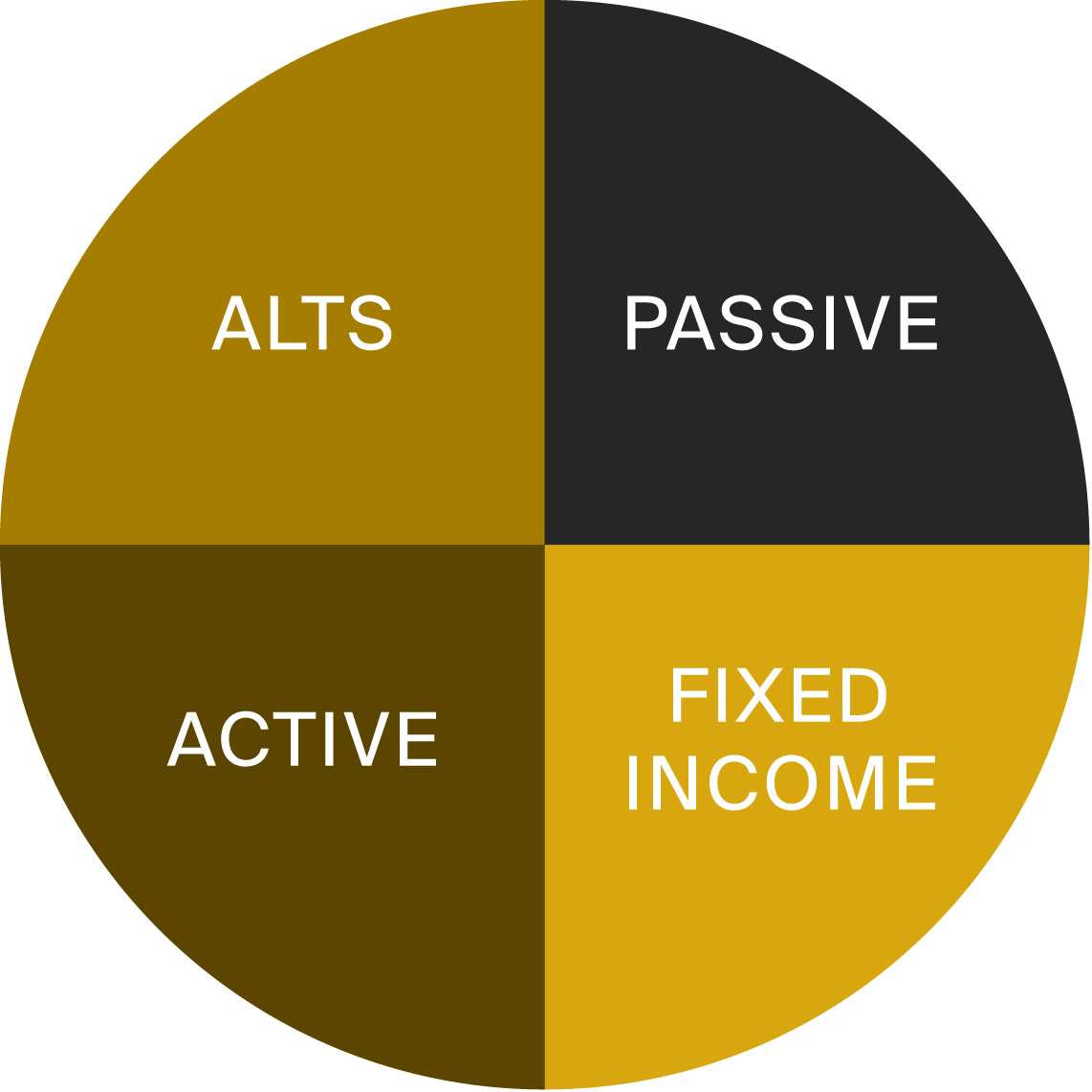

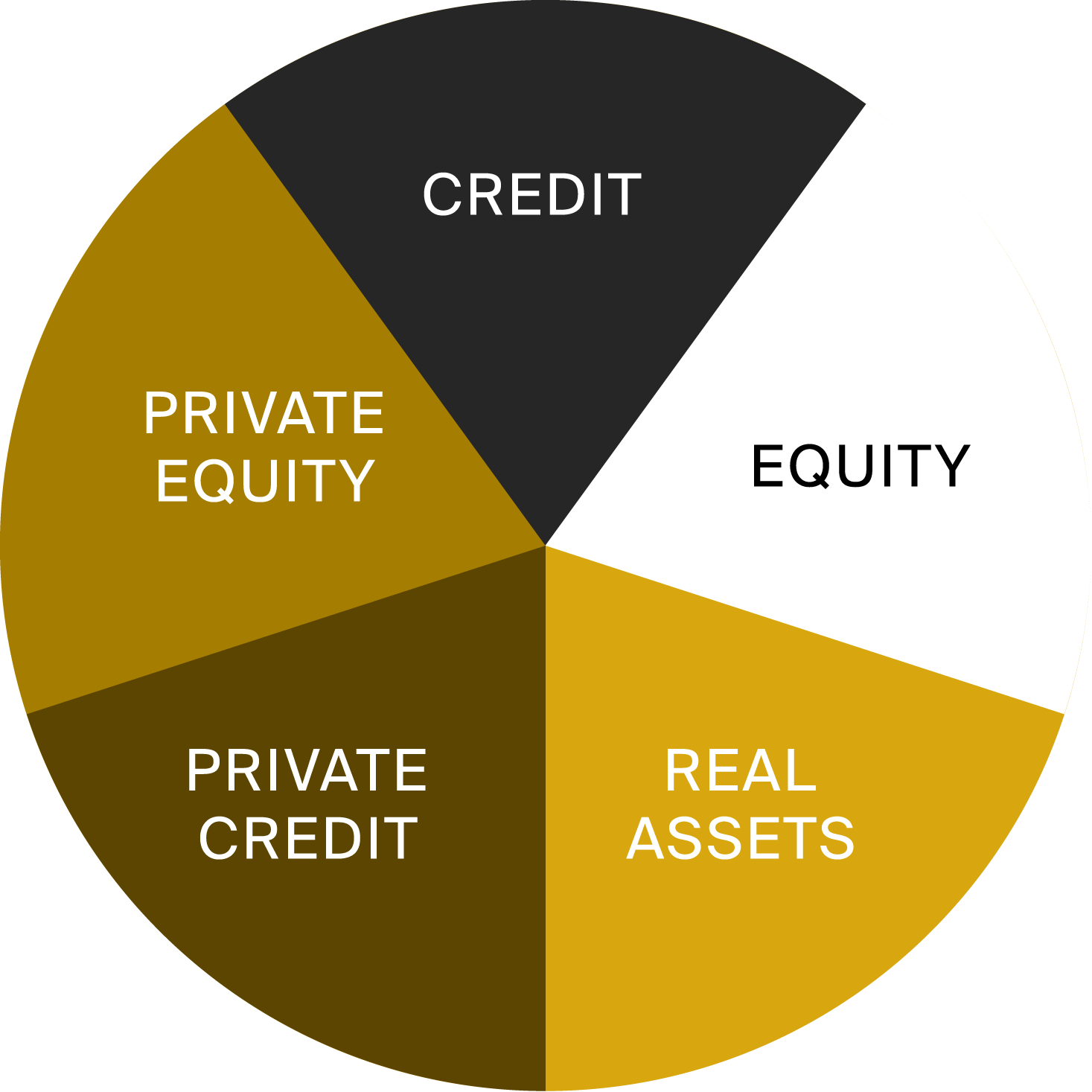

The Evolution of Asset Allocation

Investment strategies have undergone a profound transformation over the past century. As markets evolved and access to new asset classes expanded, so too did the way portfolios are structured for long-term growth and resilience.

At Essentia, we embrace this modern, multi-asset approach to help clients capture broader opportunity sets. It's a key pillar of our investment philosophy, and a powerful engine for long-term, risk-adjusted returns.

General FAQs

Contact us for more information